Here are all the necessary details on Aspire Student Loan. Understanding the Aspire student loan process, from application to repayment, is critical to your current and future financial success.

Read on for all the information on the process, application and repayment of Aspire student loan.

About Aspire Student Loan

Aspire student loan is powered by the Pennsylvania Higher Education Assistance Agency and the U.S. Department of Education. It is run by Aspire Servicing Center, a division of Aspire Resources Inc.

Access and use of the System must be authorized by Aspire Resources Inc. for legitimate student lending and higher education purposes.

Aspire Student Loan: Life Cycle of a Loan

Aspire student loan offers you the option of a federal or private student loan. Whether you use federal or private student loans to supplement other forms of aid, you must understand how each type of loan works in order to repay it successfully.

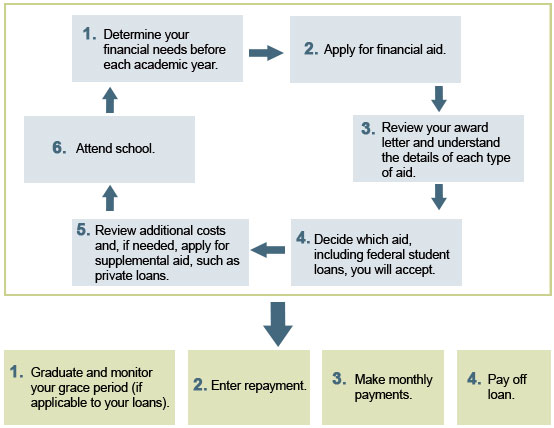

The figure below shows the life cycle of Aspire student loans.

The process is quite simple. Let us itemize it for you:

- The first process is for you to determine your financial needs before and during the academic year.

- If you have financial needs, you can now apply for financial aid.

- After successful application, you will need to review your award letter and understand the details of each type of aid.

- Decide which aid, including federal student loans, you will accept.

- Review all the costs involved and also your financial needs for your academics. Apply for supplementary aid, such as private loans, if needed.

- Get your Aspire student loan and attend school.

Private Student Loans

If you still need money for college after deducting your earnings, savings, and all other sources of student financial aid, a supplemental private student loan can help. These loans are subject to credit approval and may necessitate the participation of a cosigner. Remember to work with your college or university’s financial aid professionals to explore and exhaust all other sources of student financial aid before applying for a private loan.

How to Apply for Aspire Student Loan

Start your application process for Aspire student loan by creating an account with Aspire Servicing Centre.

Click the create account link below to get started.

After which, you will be required to submit your accompanying documents. The process of submitting your documents is as follows:

- Read and consent to the disclosure of the electronic communication.

- Provide identifying information.

- Check your email for a unique URL.

- Upload your document(s).

Forms and Documents to be Submitted for Aspire Student Loan

You may submit the following forms and documents:

- Income-driven repayment plan requests

- Auto-debit payment authorization

- Deferment and forbearance requests

- Military orders

- Proof of address or name changes

- Third-party authorizations

- Future payment allocation

- Request for employment verification

- Form W-2

- Paystub

- Taxes

- Private loan self-certification

- Loan application authorization forms

Note: You may not submit signed applications and credit agreements electronically.

The final process is to start your loan application. Click on the Start a Loan Application link on the application portal.

Repaying Your Aspire Student Loan

Once you are ready to repay your Aspire student loan, you need to understand all the options available to you.

There are several ways to submit your monthly payments, depending on your preferences. Examine your options and choose the best method for you.

Several repayment plans for federal and private student loans are also available, depending on your eligibility.

You should also look into programs and benefits for which you may be eligible, such as loan forgiveness and military benefits.

Make timely payments when in repayment. Submit each payment on time (or earlier) regardless of whether you:

- Do not graduate.

- Are planning to enroll in school again.

- Are in the process of applying for deferment or forbearance.

- Are not happy with your education.

You may qualify to temporarily delay payments on your student loans if you are:

- Currently enrolled in school.

- Experiencing financial hardship.

- Unemployed.

- Deployed for military service.

- A victim of a natural disaster.

- Experiencing other qualifying difficulties.

Aspire Student Loan Responsibilities

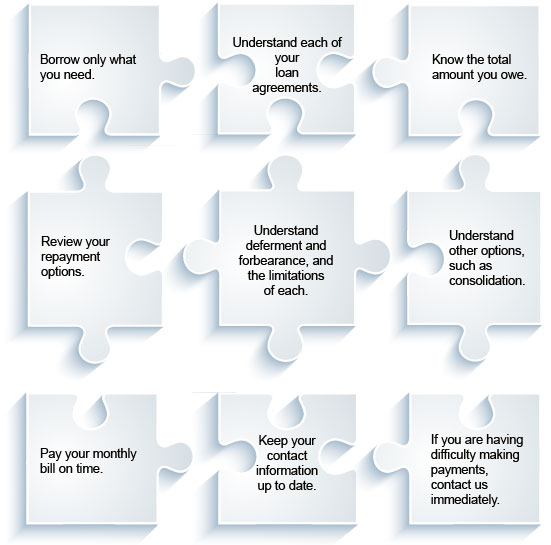

Keeping up with student loan payments can help you avoid fees, keep payments affordable, and protect your credit rating.

To accomplish this, you should understand the specifics of your individual student loans and take a proactive approach to stay informed and make payments.

Check the diagram below for your Aspire student loan responsibilities.

Consequences of Default of your Aspire Student Loan

Default occurs when you fail to make scheduled student loan payments per the terms of your credit agreement or promissory note.

If you do not pay or default on your Aspire student loan, a number of things may occur.

We don’t want you to suffer the consequences of default. Contact Aspire Servicing Center as soon as you realize you won’t be able to make a scheduled payment — assistance options may be available to you.

Late payments, missed payments, or other account defaults may appear on your credit report.

If you default on a federal loan, the U.S. Department of Education may impose additional penalties, including but not limited to the following:

- Becoming ineligible for federal financial aid in the future.

- Losing the eligibility for loan deferment or forgiveness on the defaulted loan.

- Having the entire balance on your loan(s) become due immediately.

- Requiring your employer to withhold money from your paychecks to pay your debt.

- Withholding of federal or state tax refunds through a tax offset.

Ways to Pay

Aspire Servicing Center offers several ways to pay your Aspire student loan bill. The following are available options to repay your Aspire student loan:

1. Pay with the Mobile App

Making payments is easier than ever. Use the Aspire Servicing Center mobile app to make payments from anywhere.

2. Pay Online

Access your online account to make a payment online. To access your online account for the first time, you will need your loan account number or Social Security number and date of birth.

3. Auto-Debit

Auto-debit allows you to make your scheduled monthly student loan payments on time with less hassle. After signing up for the free auto-debit program, we will deduct your monthly payment from your checking or savings account.

Aspire Student Loan Repayment Plans

Aspire Servicing Centre offers repayment plan options to fit your circumstances and help you successfully repay your student loans, whether you are about to begin repaying your loans or have been making payments for some time.

Different plans can assist you in repaying your loans as quickly as possible, while others will allow you to reduce your monthly payment amounts to help you balance your budget.

Understanding the distinctions between federal and private student loan repayment plans is critical.

Federal student loan repayment plans:

You have several options for repaying your federal student loans, including Federal Stafford, PLUS, and Consolidation loans. The federal government establishes the guidelines for these programs.

Standard

The Standard Repayment Plan is the basic repayment plan for all federal student loans.

Using this plan, you will pay off your Aspire student loan:

- In the shortest amount of time.

- With the least amount of interest.

- In 10 years or less, except for consolidation loans.

- If you’re able to afford Standard Repayment Plan payments, it is in your best interest to make payments using this plan, as you will pay less interest over the life of your loans on this plan.

Graduated

The Graduated Repayment Plan lets you begin with lower payments that then increase every two years.

Using this plan, you will:

- Pay more interest over the life of the loans because the principal balance will decrease at a slower rate.

- Pay off your loans in 10 years or less, except for consolidation loans.

Extended

The Extended Repayment Plan lets you make payments over a longer repayment term.

Using this plan, you will:

- Pay more interest over the life of the loans because the principal balance will decrease at a slower rate.

- Have up to 25 years to repay your loans.

- Have the choice to make level or graduated payments.

To qualify for the Extended Repayment Plan, you must meet two criteria:

- Have no outstanding balance on a Federal Family Education Loan Program (FFELP) loan as of Oct. 7, 1998, or on the date you obtained an FFELP loan after October 7, 1998.

- Have more than $30,000 in outstanding FFELP loans.

Income-Based

The Income-Based Repayment (IBR) Plan was created for borrowers with outstanding federal student loan debt that is higher than or represents a significant portion of their annual income.

Using this plan:

- Your maximum monthly payment amount will be 15% of your discretionary income but no more than payments under the Standard Repayment Plan.

- Monthly payments may be as low as $0.

- Any remaining loan balance after 25 years of payments will be forgiven.

- You must qualify for reduced payments under the IBR Plan by submitting income and family size information on an annual basis.

How to Appy for the Income-Based Repayment Plan

- Apply electronically at Federal Student Aid or download the IBR Request Form Instructions (PDF) and Request Form (PDF).

- You can see estimates of your monthly payment amounts under the IBR Plan using the U.S. Department of Education’s Repayment Estimator.

Income-Sensitive

The Income-Sensitive Repayment Plan bases your monthly payment amount on a percentage of your annual income; payments are between 4% and 25% of your verified gross income.

Using this plan:

- Your payments will never be less than the amount of interest that accrues between payments.

- You will pay more in interest over the life of your loans because the principal balance will decrease at a slower rate.

- You must qualify for an Income-Sensitive Repayment Plan by providing us with documentation of your monthly gross income on an annual basis.

How to Apply for the Income-Sensitive

To apply, download, complete, and submit the Income Sensitive Repayment Plan Form (PDF).

Private student loan repayment plans

You may have several repayment options for your private loans, and when you begin repaying, the terms of your specific loans will be determined.

- Many private loans we service automatically defer repayment of principal and interest while you are enrolled at least half-time, as defined by your school, and during the separation period.

- Some private loans may require interest-only, partial or full principal and interest payments during those same periods or under other circumstances.

- Most refinance loans go into immediate repayment.

- Non-traditional school and refinance loans may have other payment programs and assistance options.

- If your account was transferred from Higher Education Servicing Corporation or is owned by Baptist Credit Union, your private student loans are eligible only for the Standard Repayment Plan.

- Your specific credit agreement provides details on when you must begin making monthly payments.

Reducing Accrued Interest

When payments are not required, such as while in school or on deferment, interest is accruing on the loans. You may make optional payments to cover the accrued interest during these periods. If interest capitalizes, or is added to the principal balance of your loans, when the deferment ends, this can help reduce the amount of interest you will repay over time.

Standard

The Standard Repayment Plan is the basic repayment plan for all private student loans.

Using this plan, you will pay off your loans:

- In the shortest amount of time.

- With the least amount of interest.

The minimum monthly payment amount under the Standard Repayment Plan will be equal to the amount necessary to repay the loan in full by the end of the repayment term. Your repayment term may vary. Please refer to your credit agreement for term information about your specific loan or contact us to determine your repayment term.

Graduated

The Graduated Repayment Plan lets you begin with lower payments that increase by 10% every two years. Using this plan, you will pay more in interest over the life of the loan because the principal balance will decrease at a slower rate.

If you have variable-rate loans, the 10% increase in payments is in addition to any adjustments made due to increases in the interest rate.

This plan is typically not available for loans with repayment terms of less than 10 years. Your repayment term may vary. Please refer to your credit agreement for term information about your specific loan or contact us to determine your repayment term.

Select 2

The Select 2 Repayment Plan lets you make mostly interest-only payments during the first two years of repayment. The amount increases to a standard amount for the remainder of the repayment term, which may vary. Approval for this repayment plan is dependent on the remaining loan term and other factors, including the remaining principal balance.

Using this plan, you will pay more in interest over the life of the loan because the principal balance will decrease at a slower rate. Please refer to your credit agreement for term information about your specific loan or contact us to determine your repayment term.

How to Find the Best Plan for You

If your payment amount under the Standard Repayment Plan is unmanageable, call (800) 243-7552 to speak with an experienced customer service representative to find the best plan for you.

Delay a Payment of Your Aspire Student Loan

If you need some financial help, you may be able to delay or postpone your Aspire student loan payments.

Federal Student Loans

1. Delay Payment Through Deferment

One way to delay payment on your federal student loans is to use a deferment.

The federal government will pay the interest on your subsidized student loans during authorized deferment periods.

To learn more about options, visit studentaid.gov/h/manage-loans or call (800) 243-7552.

2. Delay a Payment Through Forbearance

Forbearance is another option to delay payments on your federal loans if you don’t qualify for deferment.

Forbearance is granted at the discretion of your lender.

Private Student Loans

Private student loans may also be eligible for repayment assistance. Contact Aspire Servicing Centre for assistance with private loan deferment.

Aspire Student Loan Forgiveness and Discharge

Aspire student loan debt may be forgiven or discharged in certain circumstances.

For more information on forgiveness or discharge for federal loans:

- See information on the Limited-Time Public Service Loan Forgiveness Program

- Visit the Federal Student Aid site

Conditions for Aspire Student Loan Forgiveness and Discharge

1. Specialized Careers

If you perform certain types of work, some of your qualifying loan debt may be forgiven.

- Nurses.

- Teachers.

- Workers in public service who have federal Direct Loans.

2. Death or Total and Permanent Disability

Different loan programs have different requirements in the unfortunate event of:

- A borrower’s death or total and permanent disability.

- A cosigner’s death or total and permanent disability.

- The death or total and permanent disability of the student for whom the funds were borrowed.

♣ Please call Support to determine if your loan debt or obligations may be forgiven under these circumstances.

♣ If you qualify for loan forgiveness, please consult a tax professional or the IRS for information about possible tax consequences.

Income-Based Repayment

The remaining debt may be forgiven if you make qualifying payments under the Income-Based Repayment (IBR) Plan for 25 years.

False Certification, School Closure and Unpaid Refund

Qualifying federal loans may be forgiven in exceptional circumstances, such as if your school closed before you finished your program, if your school falsely certified your eligibility or if your identity was illegally used to obtain a loan in your name, or if your school failed to issue a required refund when you withdrew from school.

Bankruptcy

Student loans are not automatically discharged by bankruptcy; the borrower must demonstrate that repaying the loans would cause undue hardship in order for the bankruptcy court to discharge them.

Aspire Student Loan Money Tips

Using a budget to track how much you earn and how much you spend each month is one of the best ways to manage your money.

Set financial and savings goals, plan for emergency expenses, and manage your Aspire student loan obligations with your budget.

How to Make a Budget

To make a budget:

- Determine your earnings. Make a list of all of your sources of income.

- Keep track of your expenses. Determine how much you are currently spending. Examine your receipts and bills, or keep track of all your monthly expenses.

- Examine the outcome. Using a budget calculator, subtract your total expenses from your total income. If you make more money than you spend, you may want to pay down more debt or put more money away. If you spend more than you earn, your top priority should be to cut costs or increase income.

That is it for Aspire student loan. We hope you found this article informative. Do well to check our site for other great content.